- Where We Work

- Africa

- African Union

- Power Africa

- About Us

- How We Work

- Partners

- COVID-19

- News & Information

- Power Africa Jobs

- Power Africa Toolbox

- Where We Work

- Events

- Trade and Investment

- Angola

- Benin

- Botswana

- Burkina Faso

- Burundi

- Cameroon

- Central Africa Regional

- Central African Republic

- Chad

- Côte d'Ivoire

- Democratic Republic of the Congo

- Djibouti

- East Africa Regional

- Eswatini

- Ethiopia

- Ghana

- Guinea

- Kenya

- Lesotho

- Liberia

- Madagascar

- Malawi

- Mali

- Mauritania

- Mozambique

- Namibia

- Niger

- Nigeria

- Republic of the Congo

- Rwanda

- Sahel Regional

- Senegal

- Sierra Leone

- Somalia

- South Africa

- South Sudan

- Southern Africa Regional

- Sudan

- Tanzania

- The Gambia

- Uganda

- West Africa Regional

- Zambia

- Zimbabwe

- Asia

- Europe and Eurasia

- Latin America and the Caribbean

- Middle East

- Mission Directory

Speeches Shim

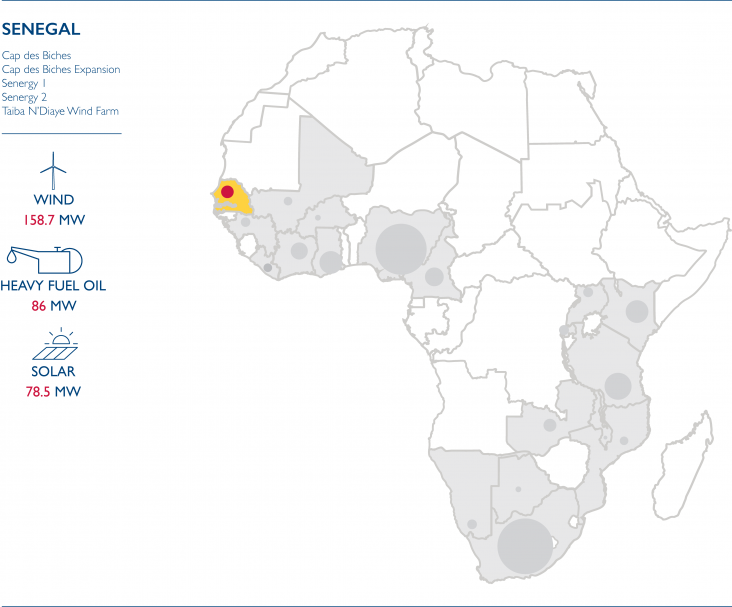

Power Africa has supported the development of 383 megawatts (MW) of electricity generation projects in Senegal. In addition, various firms have received U.S. Embassy support to move transactions forward.

The exhibits below illustrate Power Africa’s financially closed transactions in Senegal, some of which are already online and generating critical electricity supply for the people of Senegal.

Power Africa Financially Closed Transaction in Senegal

Senergy 1 (Solar – 29MW)

Financial Close Date: 04/11/2016

Commercial Operations Date: 12/31/2017

Estimated Project Cost: $47.9M

Overview: Power Africa advanced the 29 MW Senergy I transaction to financial close in 2016 through a range of support to project stakeholders. This support included evaluation of the project financial model and the PPA to ensure bankability. Overseas Private Investment Corporation insurance was also provided on the project. Power Africa partner Proparco granted a loan to the project, and Schneider Electric, also a Power Africa partner provided equipment. The President of Senegal, Macky Sall, inaugurated the Senergy solar power plant in Santhiou Mékhé in June 2017.

Senergy 2 (Solar – 20MW)

Financial Close Date: 05/22/2016

Commercial Operations Date: 10/22/2016

Estimated Project Cost: $28M

Overview: This project is a 20 MW PV generation plant in the north of Senegal and was the first grid connected solar IPP in West Africa. The project provides access to power for 160,000 people. The electricity produced by Senergy 2 is being sold to the Senegalese power utility Senelec through a 20-year Power Purchase Agreement (PPA). The project was jointly developed by Power Africa partner GreenWish and SENERGY 2, with support from the US Government. Alongside the equity investors, the project was financed through a loan provided by Green Africa Power, a multilateral investment vehicle dedicated to enabling private investment in clean power in Africa, jointly financed by the governments of the United Kingdom, Norway and the Netherlands, alongside other development finance institutions.

Taiba N’Diaye Wind Farm (Wind – 158.7MW)

Financial Close Date: 07/30/2018

Commercial Operations Date: 07/31/2020

Estimated Project Cost: $377M

Overview: Power Africa supported the Taiba N’diaye transaction, which is the first wind project in Senegal, for three years with assistance on financing, insurance, negotiation, and land rights issues to the developer. Taiba N’Diaye, will consist of 46 Vestas wind turbines, each able to produce 3.45 MW under a full Engineering Procurement and Construction contract. Lekela Power and Actis (UK) and a consortium led by Mainstream Renewable Power (Ireland), acquired co-development rights and sole invest rights in the project. Overseas Private Investment Corporation provided both financing and insurance to the project, as well as a grant through the US Africa Clean Energy Financing Facility. The World Bank's Multilateral Investment Guarantee Agency provided political risk insurance.

Ten Merina Ndakhar (Solar – 29.5MW)

Financial Close Date: 12/07/2016

Commercial Operations Date: 06/30/2017

Estimated Project Cost: $45.2M

Overview: The Ten Merina Ndakhar project constructed and operated a 29.5 MW PV solar farm in Merina Dakhar Commune located approximately 120 km northeast of Dakar. The project is a partnership between the two French companies Meridiam (85 percent), the financier, and Eiffage (15 percent), which carried out the construction and operation of the power plant. The company signed a 25-year Purchasing Power Agreement with SENELEC, and was supported by the BIO and Proparco. Construction was conducted by Solairedirect (subsidiary of ENGIE) and RMT. The project reached financial close in December 2016 and was commissioned in January 2018. OPIC committed $2.96 million in reinsurance to ito the project

Cap des Biches Expansion HFO (HFO – 33MW)

Financial Close Date: 01/25/2017

Commercial Operations Date: 03/30/2018

Estimated Project Cost: $85M

Overview: The Cap des Biches Expansion project added 33 MW of capacity to the existing 53 MW electric power plant in Senegal. The expansion consists of two combustion engines, one of which is equipped with a heat recovery system, and a short transmission line connecting the expansion units to an existing substation. The power plant will use heavy fuel oil with the option to convert to natural gas. ContourGlobal is the project developer responsible for this expansion and OPIC committed $53 million in financing and $23 million of political risk insurance. The project reached financial close in January 2017.

Cap des Biches HFO (HFO – 53MW)

Financial Close Date: 12/17/2015

Commercial Operations Date: 06/13/2016

Estimated Project Cost: $134M

Overview: Cap des Biches is a combined cycle, heavy fuel, oil-fired thermal power plant capable of high efficiency rates with lower power generation costs. ContourGlobal, an international power generation company, signed an agreement with the Senegalese national utility SENELEC, to rehabilitate the existing Cap des Biche brownfield site and construct a new 53 MW heavy fuel oil fired thermal facility under a 20-year Power Purchase Agreement. The project reached financial close in December 2015 and was commissioned in June 2016. This project’s financing model brings together two leading development finance institutions: OPIC and IFC, with OPIC committing financing up to $116 million and $25 million of political risk insurance for Phase I of this project, and IFC providing an 18-year cross currency swap of the same amount. The IFC provided political risk insurance while ContourGlobal provided $23.15 million in equity.

Comment

Make a general inquiry or suggest an improvement.