- Work With USAID

- How to Work with USAID

- Organizations That Work With USAID

- Find a Funding Opportunity

- Resources for Partners

- Preventing Sexual Misconduct

- USAID Partners

- Acquisition & Assistance Ombudsman

- Acquisition & Assistance Policy Directives

- Development Information Solution (DIS)

- Indirect Cost Rate Guide for Non-Profit Organizations

- Procurement Executive Bulletins (PEBs)

- Progress Report - Fiscal Report 2019

- Implementing Partner Notices Portals

- Partner Vetting System

- Branding

- COVID-19 Guidance For Implementing Partners

- Preparing for a World Altered by COVID-19

- Section 889 Partner Information

- Careers

- Get Involved

Speeches Shim

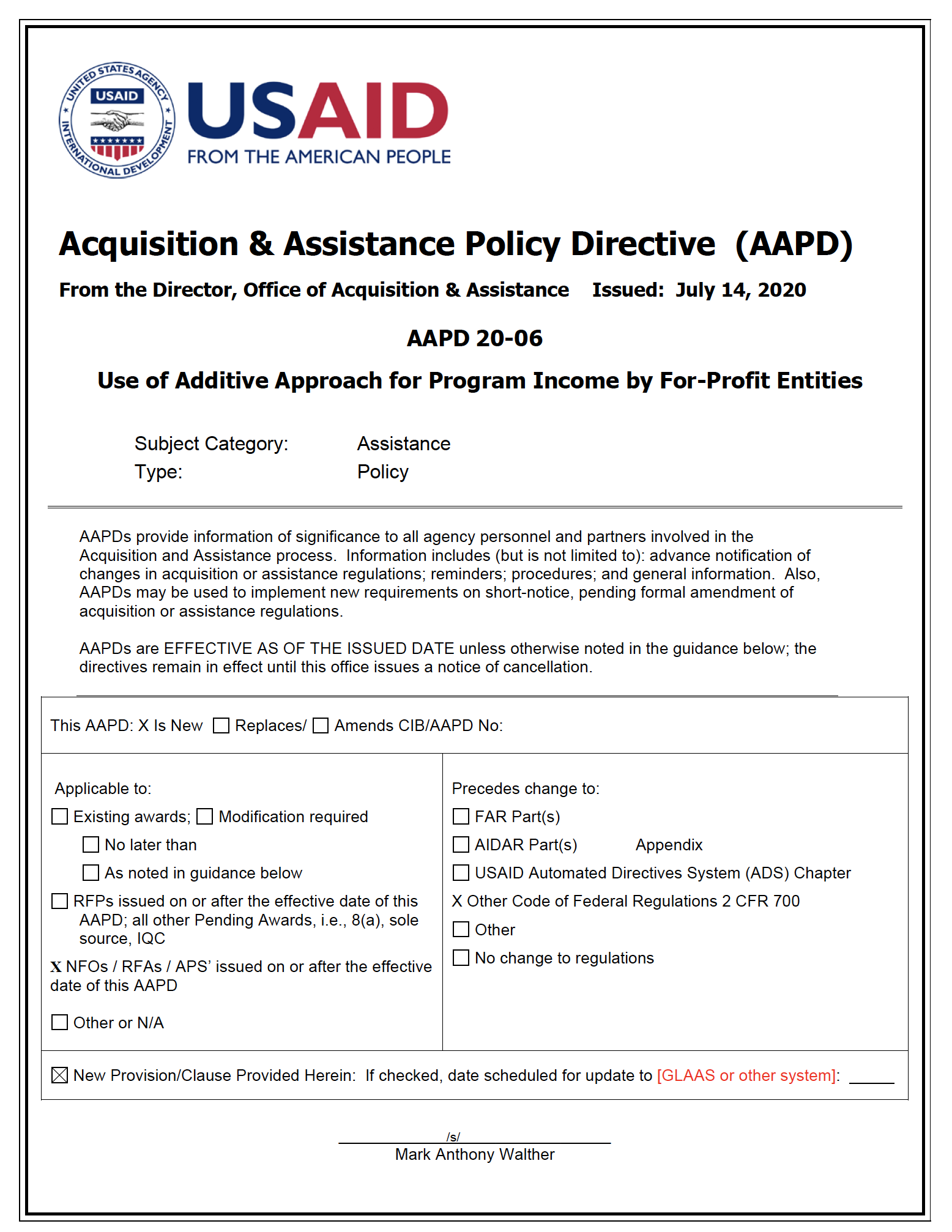

![]() (88k) AAPD 20-06

(88k) AAPD 20-06

AAPD 20-06: Use of Additive Approach for Program Income by For-Profit Entities

AAPDs provide information of significance to all agency personnel and partners involved in the Acquisition and Assistance process. Information includes (but is not limited to): advance notification of changes in acquisition or assistance regulations; reminders; procedures; and general information. Also, AAPDs may be used to implement new requirements on short-notice, pending formal amendment of acquisition or assistance regulations.

Subject Category: Assistance

Purpose:

This AAPD notifies Agreement Officers (AOs) that a class exception to 2 CFR 700.13(a)(2) was approved by the AA/M to allow AOs to authorize the additive approach of program income for assistance awards to for-profit entities to be used for the purposes and under the conditions of the USAID award. This change will be made in 2 CFR 700 through the rule-making process, as shown in Tab 1. In the meantime, AOs must follow the requirements in this AAPD.

Required Action: If program income is anticipated, the AO determines the most appropriate use of such program income and must specify in the award how such program income will be treated. This may include applying one of the three approaches (deduction, addition, or cost- sharing) described at 2 CFR 200.307(e). The AO must insert the applicable Standard Provision, “Program Income” in assistance awards to both U.S. and non-U.S. NGOs.

BACKGROUND:

Program Income

2 CFR Part 700 is the USAID supplemental regulation adopting the Office of Management and Budget’s Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards to NonFederal Entities (subparts A through F of 2 CFR Part 200). 2 CFR 700.13(a)(2) states: “Program income. As described in §200.307(e)(2), program income earned by a for-profit entity may not be added to the Federal award.”

However, a class exception to 2 CFR 700.13(a)(2) was approved by the AA/M. This means AOs are now authorized to approve the additive approach for program income generated under an assistance award to any recipient, even if it is a for-profit entity.

Effective Partnering and Procurement Reform (EPPR)

Recommendation 31 of the EPPR initiative states:

Revise Agency policy (2 CFR 700.13) to allow use of “program income.” Federal regulations allow the USG to reinvest any financial returns generated from an activity, known as “program income” with a private sector partner. USAID does not use this authority, unless an exception is granted. As a result, USAID is potentially forgoing opportunities to expand the results of ongoing activities. Policy will be updated to allow for this “additive approach” and guidance will be developed to support its use. Responsible Bureau(s): LAB, E3, M, GC.

Based on this recommendation, the Agency has approved a class exception to 2 CFR 700.13(a)(2) to allow AOs to use the additive approach for program income in assistance awards made to for-profit entities. This AAPD provides the initial guidance required by the EPPR recommendation for the use of program income added to a for-profit entity’s funding under a USAID award.

AAPDs are EFFECTIVE AS OF THE ISSUED DATE unless otherwise noted in the guidance below; the directives remain in effect until this office issues a notice of cancellation.

Date Issued: July 14, 2020

Comment

Make a general inquiry or suggest an improvement.