Speeches Shim

The private sector plays a critical role in shaping sustainable economic and social development. That’s why USAID Peru engages with corporations, local businesses, financial institutions, investment firms, private foundations and others as core partners in our efforts to drive licit growth and protect the environment. In Peru, USAID and the private sector are building mutually beneficial partnerships that leverage our respective expertise, assets, technologies, networks and resources to achieve greater development impact.

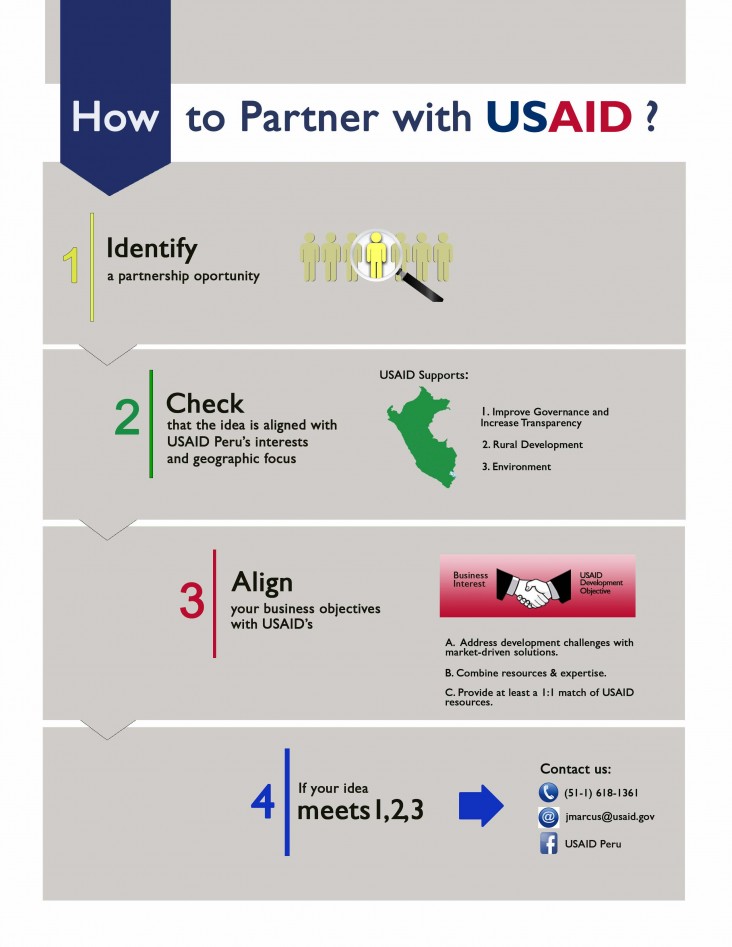

How to Partner with USAID?

-Identify a partnership opportunity with USAID/Peru

-Check that the idea is aligned with USAID Peru’s objectives and geographic focus. https://www.usaid.gov/peru/our-work

-Align your business case with USAID Peru’s objectives.

-If you have a concept that hits these three points, contact us.

Some Examples of our Work with the Private Sector:

The Peru Cacao Alliance

The Peru Cacao Alliance is a public-private partnership supported by USAID. Its objective is to increase incomes of 20,000 rural families in San Martin, Huanuco, and Ucayali regions by increasing productivity, access to markets, and promoting private investment.

HOW DOES THE ACTIVITY WORK?

USAID support is helping to facilitate farmers’ access to credit and providing financing for on-farm technical assistance packages which will increase farmers’ yields and improve the quality of their cacao. The private sector consists of buyers willing to pay a fair price for specialty cacao; and, processors, traders and input providers, all of whom are engaged in creating a more efficient, sustainable value chain for cacao.

WHAT RESULTS WILL THE ALLIANCE ACHIEVE?

The Alliance seeks to make the rural economy more dynamic in former coca growing areas by increasing the average incomes of 20,000 rural families by at least 30 percent. Farm yields are expected to nearly double over five years. The Peru Cacao Alliance will also facilitate $10 million in loans so that farmers and all value chain actors area able to invest in their production and expansion. Moreover, at the end of five years, USAID expects to double our $25 million investment, with at least $50 million of investment from its private sector partners to achieve mutual objectives.

Cafe

The Coffee Alliance for Excellence (Cafe) is a public-private partnership that seeks to increase the incomes of at least 10,000 smallholder coffee farmers in the San Martin, Huanuco, and Ucayali Regions of Peru. CAFE will achieve this objective by helping farmers to improve productivity and quality, as well as diversifying their source of income with other crops and non-farm income.. Through Café , USAID and a number of private companies – including Althelia Ecosphere, TechnoServe, and global coffee buyer Jacobs Douwe Egberts (JDE), and Peru’s largest coffee exporter Perusa, are all co-investing and taking advantage of each other comparative strengths to will help lift thousands of rural families out of poverty.

HOW DOES THE ACTIVITY WORK?

USAID, in partnership with the private sector, will increase coffee farmers’ productivity (yields) and improve the quality of their beans. . Café is grouping farmers and sharing improved production practices, which result in greater yields and more plants that are more resilient to pests and diseases. As the farmers produce more, and high quality coffee, Café will to connect them to premium markets, where they can earn a fair price for their product. Café is also providing financial literacy training, so that as yields and revenues increase, farmers will be able to secure bank financing. Meanwhile, private sector partners are committed to finance the planting of 3,000 new hectares of coffee with the advisement of the World Coffee Research, as well as the installation of new coffee collection and processing facilities.

WHAT RESULTS WILL THE ALLIANCE ACHIEVED?

CAFE will boost the incomes of 10,000 rural families by 50 percent. This will be achieved by doubling coffee yields, from 460 kilos per year per hectare to 920; installing 8,000 new hectares of specialty coffee. We anticipate that gross sales will grow from $2.8 million in 2018 to $17.3 million in 2022. More importantly, Café will provide greater consistency of quality and volumes for the private sector, building a base for the growth of the sector as well as the incorporation of specialty coffees in alternative development areas.

Development Credit Authority Loan Portfolio Guarantee

USAID offers U.S. Treasury-backed credit guarantees to partner banks to share the risk of loan default and promote increased access to financial services in underserved markets. Since 1999 our credit guarantees in Peru have unlocked $97 million in loans to over 20,000 families.

Currently, USAID Peru has a credit guarantee with three banks: Caja Maynas, Mi Banco, and Financiera Confianza. The activity aims to facilitate access to credit for producer associations and small enterprises and demonstrate to the financial sector that long-term lending to the agricultural sector is viable. The Development Credit Authority Credit Guarantee (DCA) supports lending to farmers and other actors in agricultural value chains in the former coca growing areas of Huanuco, Ucayali, and San Martin. Specific efforts are made to reach women and first-time borrowers.

HOW DOES THE ACTIVITY WORK?

DCA guarantees up to 50 percent of the loans issued by participating banks to targeted beneficiaries. USAID’s other partnerships, particularly CAFE and Alianza Cacao help to channel qualified borrower to the banks. The agreement guarantees a total of 50 percent of working capital and fixed investment loans issued by the three participating banks.

WHAT RESULTS WILL THE ALLIANCE ACHIEVED?

To date, the three bank partners have made nearly 2,600 loans totaling $5.1 million.

CRECE

Internet access in rural Peru is limited. In a digital age, this is an obstacle for licit development. Communities dependent on illegal coca cultivation are rural, isolated and without many options to earn a living. Similarly, former coca growing communities have limited access to banking services. Internet and innovative financial services will help to break this isolation and open up licit alternative livelihoods. USAID and several private sector partners are working together through the CRECE alliance to bring the internet and digital financial services to over 100 communities in the central jungle departments of San Martin, Ucayali and Huanuco. Introducing the internet in rural communities, along with access to financial services, such as savings accounts, credit and electronic payments, is part of a broader effort by USAID, the Government of Peru and the private sector to support licit economic development former coca growing areas.

HOW DOES THE ALLIANCE WORK?

The Alliance expands access to the Internet and digital services to alternative development areas by physically expanding internet connectivity into communities not previously reached by the national network. Private firms extend this access, with government incentives, and then extend customer service to new users. To ensure that services are accessible and sustainable, significant public and private investments will be made in training a cadre of network administrators and providing other related certifications as well as software tools. Together, these investments will contribute to better educational outcomes, stimulate local economies, improve access to basic government services, and contribute to greater civic engagement.

WHAT RESULTS WILL THE ALLIANCE ACHIEVED?

By 2022, we anticipate the Alliance will have achieved the following: An expanded and self-sustaining market for internet and financial services in alternative development areas. More specifically, the CRECE aims to achieve $ 5.3 million of private investment mobilized to bring internet services to rural communities; 100 communities with access to internet services, reaching 15,000 paying customers; $22 million in financial services mobilized in rural communities; 10,000 people trained on financial literacy; and about 3,750 people using mobile payment services.

Comment

Make a general inquiry or suggest an improvement.