- Work With USAID

- How to Work with USAID

- Organizations That Work With USAID

- Find a Funding Opportunity

- Resources for Partners

- Careers

- Get Involved

Speeches Shim

Blended Finance Market Development

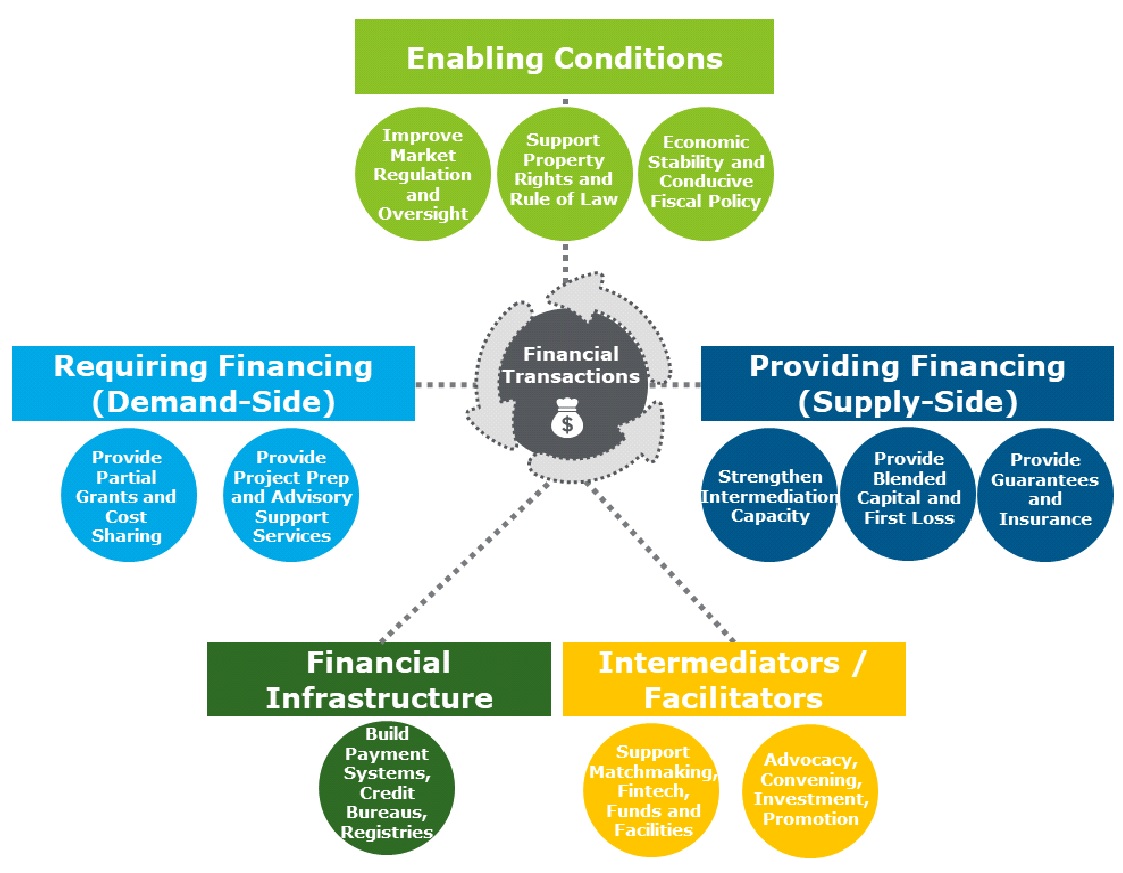

USAID CATALYZE is focused on building a sustainable supply of private capital, channeling it into high impact local firms, and ensuring a conducive investment environment. CATALYZE views this as a systemic approach, in which the five elements listed below work together to positively influence the efficacy of each financial transaction.

- Institutions that Provide Financing, thereby strengthening intermediation capacity, providing blended finance capital and first loss, and providing guarantees and insurance.

- Institutions that Require Financing, which provide partial grants and cost sharing, as well as project prep and advisory support services.

- Intermediators like fintech and fund matchers & Facilitators like advocacy, promotion, investment, and convening activities.

- Financial Infrastructure that includes credit bureaus, registries and payment systems.

- Enabling Conditions, such as improved market regulation and oversight, strong property rights and rule of law, and economic stability and conducive fiscal policy.

Full alt text for image located here.

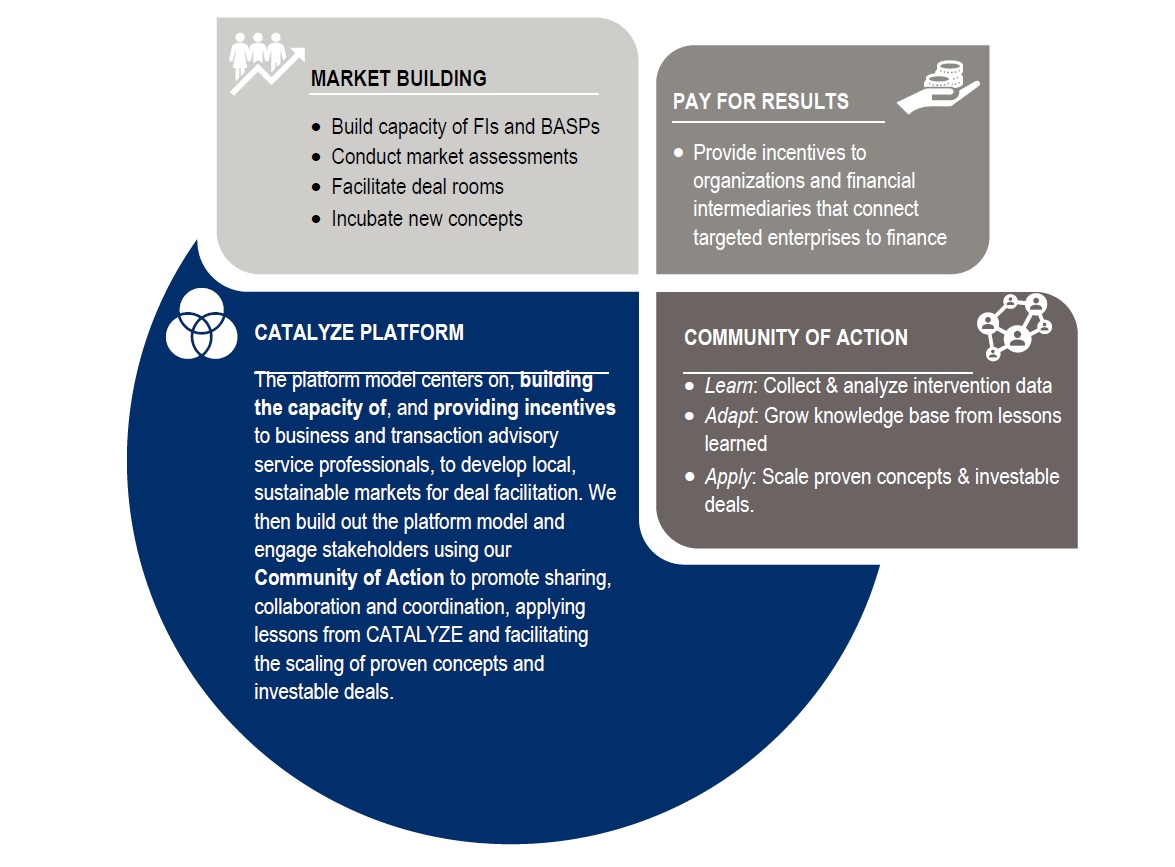

CATALYZE applies a Platform Concept to build relationships among market actors and drive systemic change using three core elements: market building to increase local capacity, pay for performance incentives mechanisms, and stakeholder engagement through a Community of Action.

CATALYZE engages with, builds the capacity of, and provides incentives to business and transaction advisory service professionals (BASPs), stakeholders that connect targeted enterprises to finance, as well as financial intermediaries (FIs), especially local institutions, to provide the needed finance to target enterprises. In addition to these incentive-driven, Pay for Results (P4R) transaction modalities, CATALYZE conducts market assessments, facilitates deal rooms, supports incubation initiatives, and rolls-out other market building and transaction support activities.

Through our robust monitoring, evaluation, learning, knowledge management and communications strategies, CATALYZE engages key stakeholders - locally, regionally, and internationally - in our Community of Action to both support the transaction-focused work and learn adapt and apply lessons from CATALYZE. This network includes the supply and demand side actors, the intermediaries and facilitators, and a diversity of stakeholders from finance and real economy sectors, such as regulators, academics and researchers, and other donors.

Full alt text for image located here.

Activities Under CATALYZE

Education Finance

![]()

Improve access to and outcomes of non-state primary and early childhood education

Women's Economic Empowerment

![]()

Support women’s employment and enterprise development

DFC/GEWE 2x

![]()

Improving the economic resiliency of financial institutions and the SMEs they serve

Ethiopia: Market Systems for Growth

![]()

Foster private enterprise growth, primarily in agricultural markets, to create jobs and increase incomes

Peru: Mobilizing Private Investment for Alternative Development

![]()

Increase access to finance for rural agricultural enterprises

Sahel

![]()

Increase financing to support capital investment in the agricultural sector

Sri Lanka: Private Sector Development

![]()

Promote economic diversification and employment opportunities for women

Western Balkans: Engines of Growth

![]()

Increase SME’s access to and use of finance to drive enterprise growth

Resiliency

Global economic shocks, such as the COVID-19 crisis, have substantial consequences for SMEs and the individuals and communities that depend on them. When properly harnessed - including through the CATALYZE approaches described above - private sector capital has the potential to bolster local markets, and in turn, support economic rebound. By working with all market actors and stakeholders (SMEs, Financial Institutions or other investors, as well as regulators, researchers and other donors) CATALYZE will:

- Help Financial Institutions craft new mechanisms that provide SMEs with more flexible financing, such as variable payment loans tied to revenues; and

- Provide SMEs with technical assistance to build their management capacity and increase their adaptability to weather crises;

These approaches will not only improve resilience to the current global crisis but will increase SMEs resiliency to future local or international shocks.

Comment

Make a general inquiry or suggest an improvement.