Speeches Shim

Background

Resource-scarce Jordan was significantly impacted by the Arab Spring repercussions in 2011 and the ensuing state of instability that engulfed the region. The disruption of Egyptian natural gas (Jordan’s most reliable source for electric power generation) has negatively impacted the energy sector. Other exogenous shocks, notably the escalating Syrian refugee crisis, have also adversely affected the tourism sector, worker remittances, and foreign direct investment (FDI), which collectively resulted in an economic slowdown, a sharp increase in the Government of Jordan (GOJ)’s deficit and a significant downturn in the country’s foreign currency reserves. The difficult economic climate was further compounded by a rise in Jordanian public expectations and calls for improved government services in regards to transparency and accountability

Project overview

In order to address the difficult socio-economic downturn, the GOJ embarked on an economic and fiscal reform journey aimed at consolidation to decrease the government deficit and prevent debt accumulation. The USAID-funded Jordan Fiscal Reform Bridge Activity (JFRBA) supports the GOJ’s economic reform efforts by strengthening fiscal policy formulation, implementation, and public financial management (PFM). JFRBA’s technical assistance focuses on helping the GoJ improve performance in public spending and administration of public resources. enhancing accountability and transparency, increasing revenue generation through sound tax policies and tax administration, developing public private partnership capacity, and facilitating trade across borders.

Activities

- JFRBA provides technical assistance and capacity building in macro-fiscal policy, debt management, and tax policy in close partnership with the Ministry of Finance (MOF) in order to enhance economic & social analysis and policy formulation to improve the government’s budget planning and allocation process.

- JFRBA works to improve public financial management by strengthening results-oriented budgeting (ROB) that is performance-based rather than input-based.

- JFRBA provides capacity-building support to the MOF’s Public-Private Partnership (PPP) unit in order to ensure that Jordan’s PPP program follows international best practices and industry norms, and ensures a transparent process that attracts infrastructure-based investments while safeguarding public interest.

- JFRBA supports the Government Financial Management Information System (GFMIS), a key tool to upgrade and enhance Jordan’s public financial management. GFMIS operates as a comprehensive integrated government financial management and accounting system that consolidates the financial and accounting information of all GOJ ministries, departments, and regional financial centers through the connection with the Ministry of Finance (MOF).

- JFRBA supports Jordan’s Income and Sales Tax Department (ISTD) in strengthening tax administration and tax reforms. Support focuses on enabling Jordan’s tax system to contribute to fiscal stability by mobilizing revenues and improving the system’s credibility.

- JFRBA continues to introduce a number of programs to facilitate trade across borders. These measures help improve Jordan’s investment and business environment in line with international trade conventions.

IMPACT

- In cooperation with the General Budget Department (GBD), JFRBA introduced a new Gender Responsive Budgeting (GRB) Manual and trained representatives from 24 government ministries and agencies on its use. The manual is the first of its kind to introduce gender-specific guidelines for budget preparation.

- In collaboration with the General Budget Department, JFRBA has worked to produce the Public Expenditure Perspectives (PEP) report. The PEP report looks at the budgetary impact of key economic sectors in Jordan. The PEP’s recommendations will help the government better chart the course of public finances and mitigate public debt risks.

- In June 2015, JFRBA assisted the MOF to issue US Government-guaranteed sovereign bonds on the international market worth US$1.5 billion. Proceeds will go to retiring old debt and supporting education and health sectors. JFRBA also supported the negotiation and finalizing of the IMF’s stand-by arrangement (SBA) for which the MOF is taking ownership. Once the SBA was implemented, JFRBA also assisted the MOF in meeting its end results by providing assistance in formulating and executing fiscal reform measures.

- JFRBA’s team has helped the GFMIS unit apply the system to 85% of the GOJ’s budget. JFRBA will continue to promote the GFMIS as the sole platform to issue the GOJ’s final account and prepare the budget. JFRBA has kick-started a plan to apply GFMIS to independent budgetary institutions, whose hidden losses have had a huge impact on the GOJ’s public debt.

- The final draft of the Benchmarking Update for 2013-2014 is in the final stages of production and approval. The study will highlight the structure and performance of the Jordanian tax system in an internationally comparative framework and will help the GoJ assess the overall efficiency of its tax system.

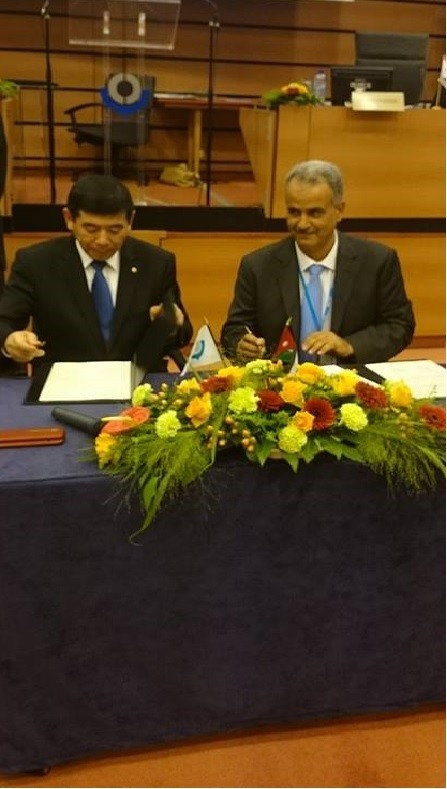

- Jordan Customs’ (JC) Regional Training Center received accreditation from the World Customs Organization (WCO). With the accreditation, JC is now able to conduct high-quality training for customs officers, partner government agencies, and private sector representatives within the region. The new training center is focused on equipping JC staff with international best practices in customs processes and trade facilitation.

- JFRBA continues to promote the Golden List, a trade facilitation program started in 2005, which gives preferred operator status to companies that demonstrate low risk as well as a strong compliance history with customs requirements. JFRBA will also continue to support JC in implementing Pre-Arrival Processing (PAP) and the Joint Inspection Mechanism (JIM) at the Aqaba Customs House. PAP and JIM will allow for faster inspection and processing of cargo and contribute to relieving congestion at the Aqaba Container Terminal.

Comment

Make a general inquiry or suggest an improvement.