India

- History

- Our Work

- Transforming Development Through Innovation & Partnership

- U.S.-India Triangular Cooperation

- Partnership for Energy Access and Security

- Partnership for Sustainable Forests in India

- Partnerships for Health

- Partnership for Education

- Partnership for Water Sanitation and Hygiene (WASH)

- Partnership for Food Security

- Partnership for Gender Equality

- Investing in Afghanistan

- Foreign Assistance Data

- Newsroom

- Newsletters and Fact Sheets

- Speeches

- Resources For Implementing Partners (RFIP)

- Careers

- Partnership Opportunities

- Success Stories

Speeches Shim

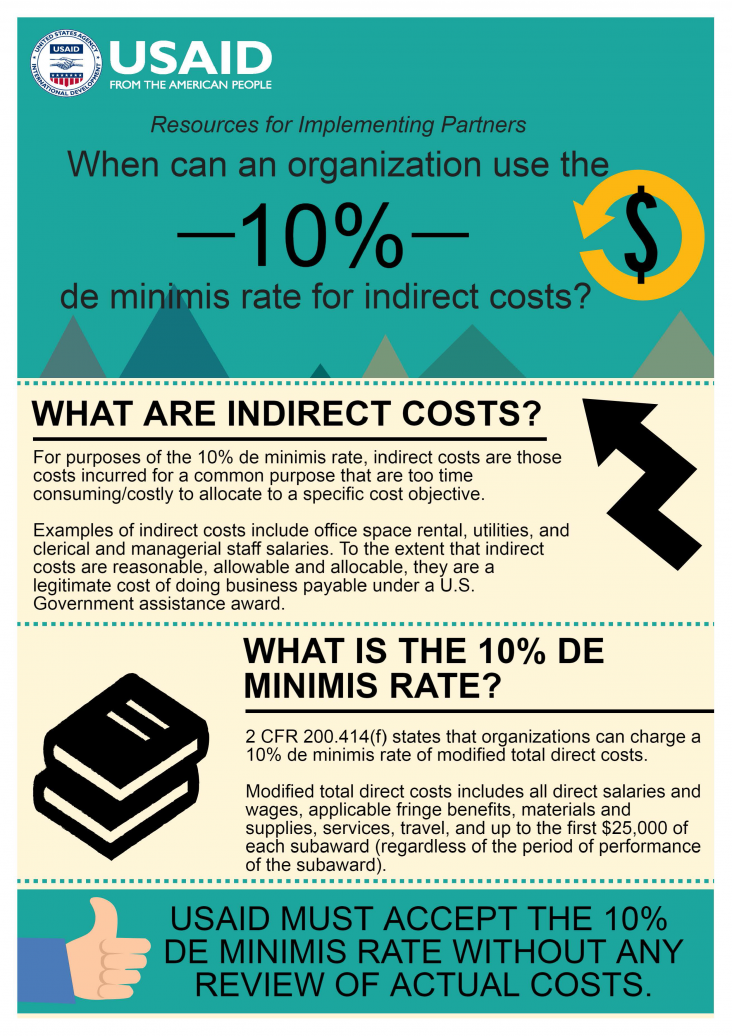

Resources for Implementing Partners

When can an organization use the 10% de minimis rate for indirect costs?

What are indirect costs?

For purposes of the 10% de minimis rate, indirect costs are those costs incurred for a common purpose that are too time consuming/costly to allocate to a specific cost objective. Examples of indirect costs include office space rental, utilities, and clerical and managerial staff salaries. To the extent that indirect costs are reasonable, allowable and allocable, they are a legitimate cost of doing business payable under a U.S. Government assistance award.

What is the 10% de minimis rate?

2 CFR 200.414(f) states that organizations can charge a 10% de minimis rate of modified total direct costs. Modified total direct costs includes all direct salaries and wages, applicable fringe benefits, materials and supplies, services, travel, and up to the first $25,000 of each subaward (regardless of the period of performance of the subaward).

USAID must accept the 10% de minimis rate without any review of actual costs.

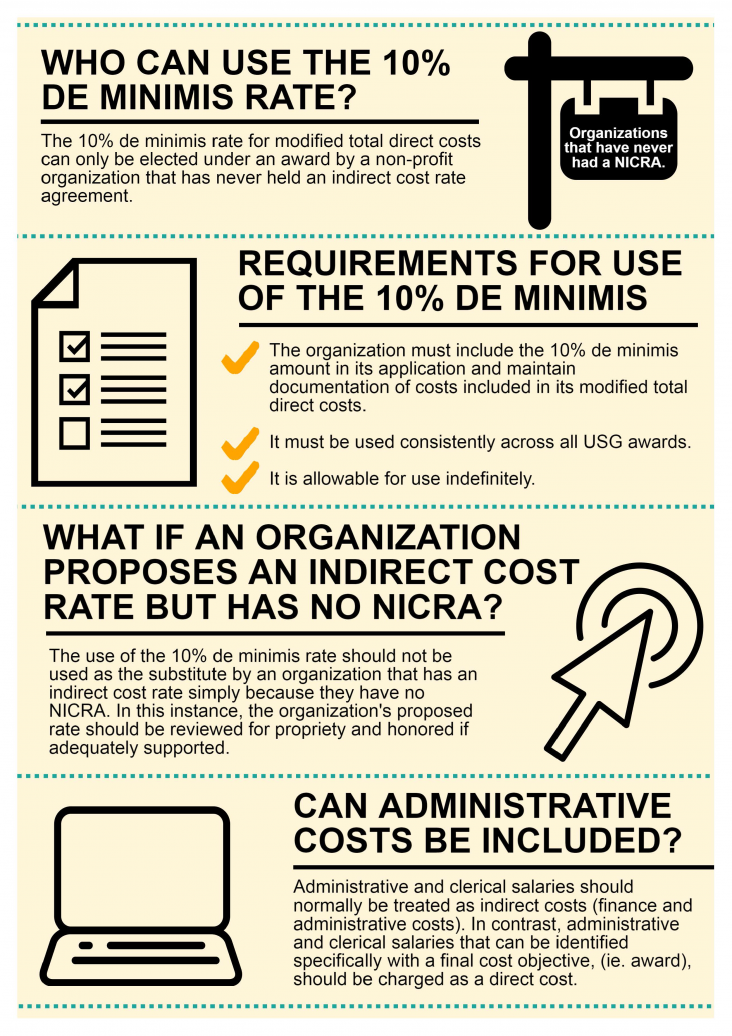

Who can use the 10% de minimis rate?

The 10% de minimis rate for modified total direct costs can only be elected under an award by a non-profit organization that has never held an indirect cost rate agreement.

Requirements for use of the 10% de minimis

The organization must include the 10% de minimis amount in its application and maintain documentation of costs included in its modified total direct costs.It must be used consistently across all USG awards. It is allowable for use indefinitely.

What if an organization proposes an indirect cost rate but has no NICRA?

The use of the 10% de minimis rate should not be used as the substitute by an organization that has an indirect cost rate simply because they have no NICRA. In this instance, the organization's proposed rate should be reviewed for propriety and honored if adequately supported.

Can administrative costs be included?

Administrative and clerical salaries should normally be treated as indirect costs (finance and administrative costs). In contrast, administrative and clerical salaries that can be identified specifically with a final cost objective, (ie. award), should be charged as a direct cost.

Where Can I Learn More?

2 CFR 200.414(f)

Appendix IV to Part 200—Indirect (F&A) Costs Identification and Assignment, and Rate Determination for Nonprofit Organizations

Developed by USAID/India’s Regional Financial Management Office and Regional Office of Acquisition and Assistance and the Central and South Asia Acquisition and Assistance Innovation Lab in support of Local Capacity Building.

Comment

Make a general inquiry or suggest an improvement.